The income tax rates at the federal level can vary from 10% to 37%. The net income of the Corporation will be divided equally by shareholders, and they will pay taxes as individuals based on their tax rates. These shareholders will pay Income Tax or other taxes as individuals. The difference between S Corporation and C Corporation is that an S corporation is recognized as a pass-through entity, so the corporation's income will be directly passed through its shareholders.

#Calculating business taxes full

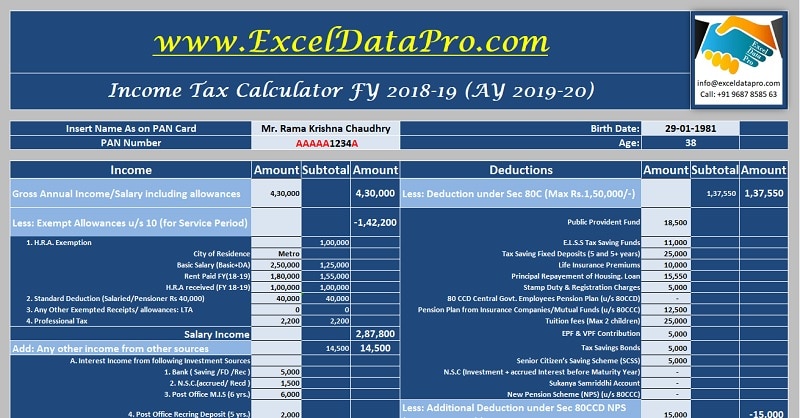

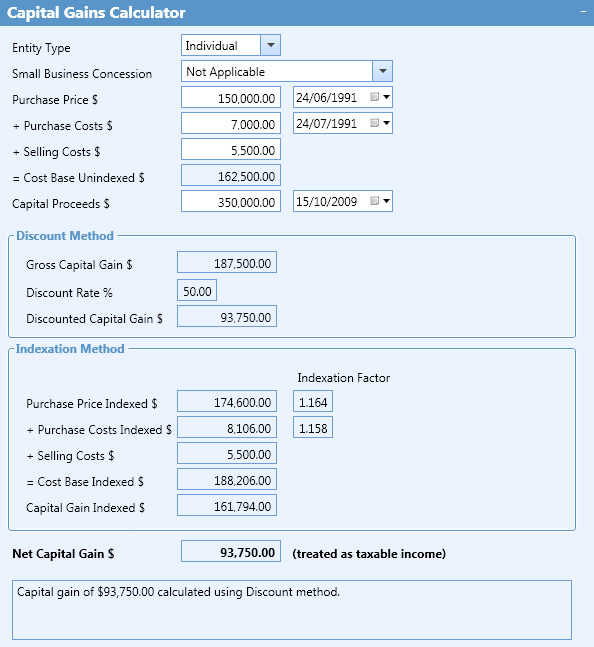

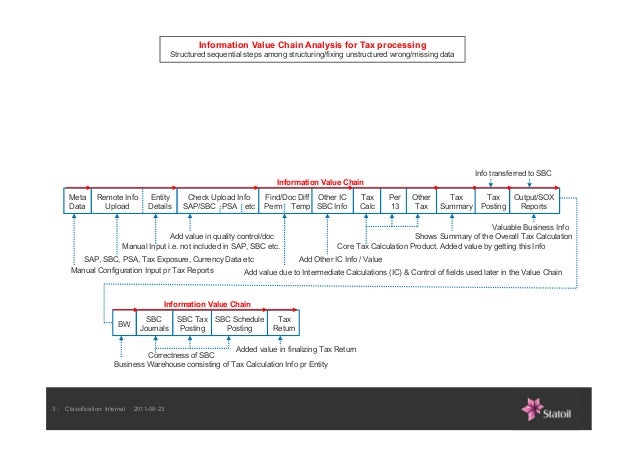

There are certain requirements and provisions that are important to be full field by sea Corporation to be recognized as a small C corporation or S Corporation. Then the shareholders that received any dividend must pay taxes whenever they file personal tax returns. What is C-Corporation Tax Rate?įiling C Corporation and paying it based on the business income and the corporate tax rate is important. However, other companies might be their income taxes on behalf of the business itself rather than pain for shareholders. One of the main factors determining tax rates is whether the government recognizes your small business entity as a pass-through.Ī pass-through entity is a small business entity recognized by a government where taxes are deducted from the individual income tax returns of the business owner. Other factors include how a small business is organized and what type of legal business determines the tax rates. Income tax rates of small business entitiesĪ main factor determining small businesses' tax rate is the business entities themselves. It is important to fulfil taxes and tax liability at least quarterly in one year to complete all the income tax obligations.ĭifferent types of taxes might be applied to small businesses besides income tax.īut to understand different taxes, it is important to know about small business tax as well as rates of specific taxes that are paid in a specific structure. The main factor that determines the tax that small businesses should pay is the income they earn. Small businesses and startups have to pay taxes as entities, while others pay taxes through their owners. The main method to deal with taxes is through income tax. There are various ways by which small businesses are taxed. For example, certain businesses must pay different taxes based on their government or municipal Corporation. The rules of taxes are different everywhere. Texas paid by a small business depends on various factors such as the type of business or location of the organization.

These taxes are payments that are important and necessary to make to local government or in a federal state.

The owners and small business companies pay many different types of taxes in small business taxes.

#Calculating business taxes how to

Here is a guide by ESPECIA to understand how tax works in small businesses and startups and how to calculate them yourself. If you hired somebody else to do the work of taxes and financing instead of you, you would never understand how to do them yourself. It is crucial to know how business taxes work to handle finances and accounting books for small businesses. Calculating business taxes is a great challenge that is faced by business owners, especially small business owners that are just getting started. You must hire somebody else to calculate small business taxes or learn to do it better.

It is a common concern faced by small business owners and small startup owners to calculate business taxes.

0 kommentar(er)

0 kommentar(er)